Financial Planning | Life | Personal Finance | Relationships & Family | Article

Sandwich Generation: How To Care For Yourself and Your Finances, While Caring For Elderly and Children

by Rica | November 16, 2023

Filipinos are known for having big, extended families. Growing up with grandparents or being raised by them while the parents go to work or living with aunts, uncles, and cousins in a single household is typical in the Philippines.

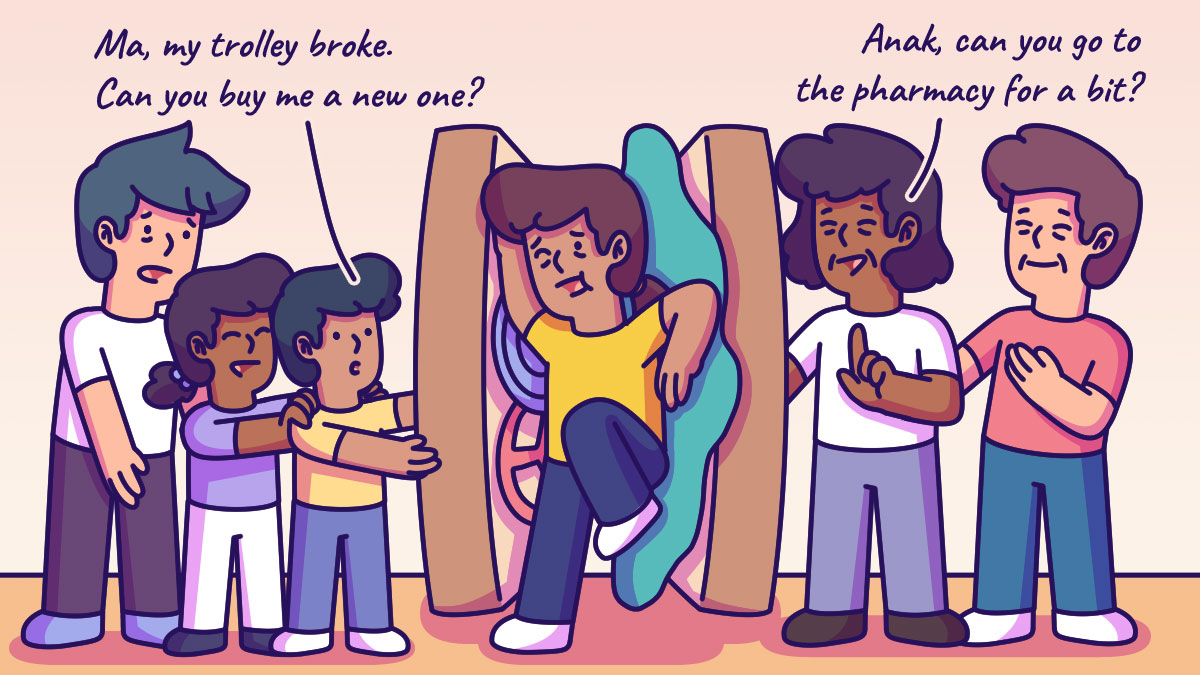

What is also very common is having both grandparents and children be physically and financially reliant on the parents, which has given rise to the term “sandwich generation.”

Coined by University of Kentucky professor and social worker Dorothy Miller in 1981, the sandwich generation describes adults wedged between caring for their parents and children.

The same term was later expanded by journalist and elder care expert Carol Abaya, M.A., to include the following:

- Traditional sandwich generation. Adults aged 40 to early 50s sandwiched between aging parents and children both needing care or help;

- Club sandwich generation. Adults in their 50s or 60s tending to their parents, adult children, and grandchildren; or younger adults ages 30s and 40s, looking after their parents and growing children; and

- Open-faced sandwich generation. Basically, anyone providing any form of elder care.

No matter where you are in the sandwich spectrum, being caught between supporting parents or older relatives and raising a family of your own sure puts you in a tough spot. Getting pulled from every direction means it’s nearly impossible to put yourself first. While understandable, it isn’t healthy – not only for your well-being but also for your finances.

Don’t neglect your needs

Supporting aging parents and young children can be draining physically, emotionally, and financially. The latter is especially true as this type of assistance is practically unpaid work. Yet, it is somehow expected of you as the caregiver of your parents and children.

Miller says that the situation of sandwich generation “exposes them to a unique set of unshared stresses in which giving of resources and service far outweighs receiving or exchanging them.”

And unfortunately, many prioritize caring for their dependents and making sure their needs are met, and feel guilty thinking about their own needs.

But the truth is you should and you need to. How else will you continue caring for your loved ones if stretched thinly?

Related

The challenges of the sandwich generation

The first step to getting better is being aware of the challenges that the sandwich generation faces. These challenges include:

Financial stress

The costs of caring for two generations can be hefty. Apart from food and daily expenses, you also need to account for medical care, particularly if you have aging parents, as well as childcare and education expenses for your children. It’s no wonder that many of the sandwich generation are stressed out because of finances.

Lack of time

One day, you need to help your mother with household errands; the next day, you are bringing your father to the doctor. Then, your child needs your help with her science project. All these are on top of your day job and housekeeping duties. It’s an endless juggling act of managing your time and it doesn’t even include time set aside for yourself.

Mental and emotional toll

Caring for parents and children isn’t just physically exhausting, it also requires mental and emotional energy. Constantly asking yourself whether you are doing enough for them can be a burden too.

Related

Overcome the challenges that the sandwich generation faces

The good news is that you can find ways out of being sandwiched between the generation above and the one after. And the earlier you start, the better.

Have an open talk with your parents

Don’t shy away from talking to your parents regarding their retirement plans. Or if they even have one. This lets you start preparing now or even getting them to consider planning for their retirement instead of just thinking that they can or should rely on you in their later years.

It’s important to be cautious when speaking to them as it can be a sensitive topic. But if done with proper timing and the right choice of words, it can go a long way to making it easier when they reach their retirement age.

You shouldn’t leave your partner and your partner’s parents out either. Discuss plans on how both of you and your partner can manage the financial situation better and this can include changes you can make in the household to lighten the load by sharing it. They might not know you need help, and they won’t unless you discuss it. You should also start thinking and planning for your own financial goals and your own retirement and how you can prepare for it.

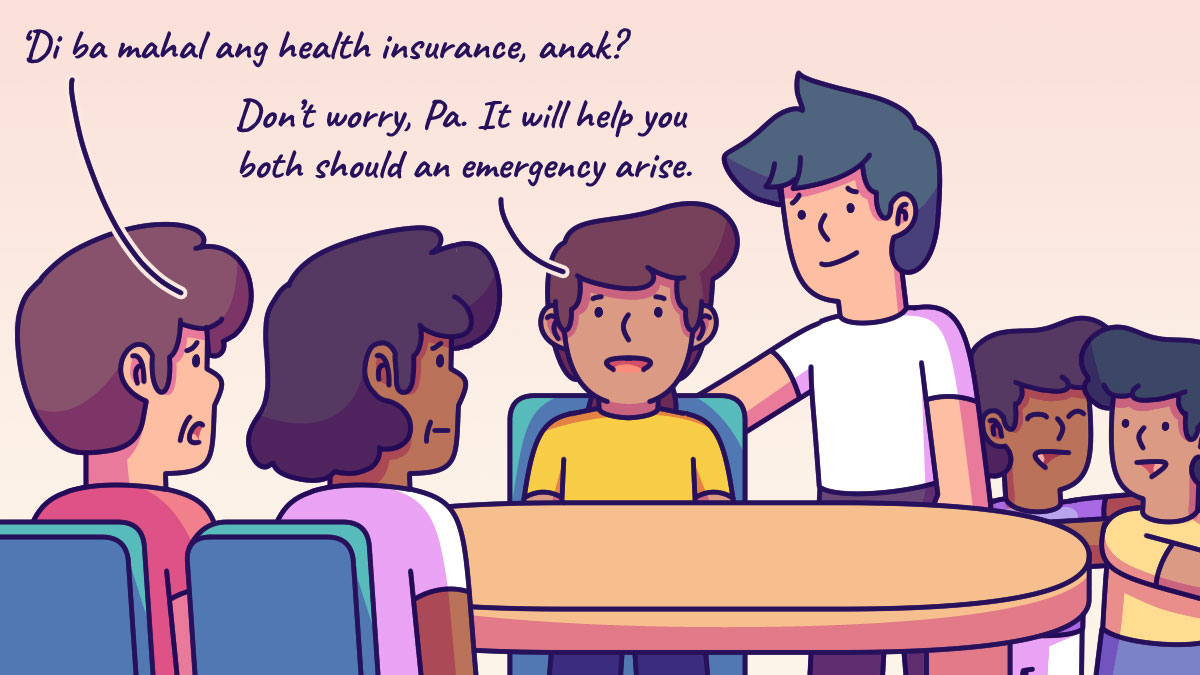

Assess the state of your finances

Regularly reviewing your financial situation will help you manage monetary challenges better. You can better plan for expenses related to parent and childcare when you have a clear picture of your finances. This should include getting family medical insurance, particularly for your aging parents.

Ask for help

You don’t need to do this alone. Whether from a family member or seeking outside support, it doesn’t hurt to ask for help. Sometimes, all you need is a listening ear to feel better and you could find support groups that have others who are also in similar situations.

You need to take time off to do the things you enjoy as well, so ask other family members for help if needed to manage physically caring for your dependents.

Self-care is crucial when you are a sandwich generation caregiver, and the sooner you realize this, the better. If others rely on you for support, you should be in tip-top shape to fulfill the demanding role.