Life | Relationships & Family | Article

I Had to Unlearn My Parents’ Financial Habits to Chart My Own Financial Journey

by Ooi May Sim | August 2, 2022 | 7 mins read

Both my parents started working from a young age. My mother grew up poor and when she wasn’t playing or going to school, she helped my grandmother sell kuih.

Before going to school, she helped my grandmother make an assortment of kuih and pastries such as curry puffs. After school, she would cycle around the neighbourhood to sell these delicacies. Though my father was slightly better off than my mother, he also found himself working while he was still in school.

As a result of their modest upbringing, my parents developed certain financial habits that are still ingrained in them to this day such as being extremely frugal. And when they raised me, they passed on these habits as teachings to me.

Although they meant well, as an adult, I’ve come to realise that some of their teachings did me more harm than good, which meant that I had to unlearn them in order to live life on my own terms.

Here are some principles I had to unlearn:

“Don’t ‘waste’ money on things that aren’t necessary”

This was the golden rule when I was growing up. Coming from a modest background, we rarely spent money on things that my parents deemed unnecessary. This means we rarely splurged on the small luxuries in life such as dining at restaurants. My parents would also tell me that if I had a pair of shoes that was still in working condition, there was no point in getting another one, even though I needed different types of shoes that suited different occasions.

Instead, my parents would only spend money on things that were practical and essential to living. Sure, it’s good to not buy things that you don’t need, but I found life all the more stressful when I didn’t make space in my budget for the things I enjoyed doing.

For example, as an adult, I wanted to take my father to a concert for his birthday when he gave me the “don’t waste money speech”. But for me, going for a concert together was a nice way to share a different experience with him.

As an adult, I had to tell myself that it’s okay to spend money on concerts, vacations and hobbies because they vastly improve my quality of life and experiences.

“Just saving money will guarantee your future”

Growing up in an Asian household meant that I was taught to save at a very young age. My parents lived by the principle that saving as much money as possible will guarantee you a stable financial future. But the money that they saved just sat in their bank account as it’s considered “safe”.

As I grew older, I realised that saving alone is not enough. With an average inflation rate of 3% every year, my money loses its value over time.

For example, if you manage to save ₱500,000 for my retirement, the value of this amount in 20 years will be equivalent to ₱276,837.88 today. This means that I can buy less things with the same amount of money in 20 years compared to now — the same amount of money won’t last as long 20 years from now.

The only way to overcome this is by investing and growing your money at the same rate as inflation or by outpacing it.

Related

Retirement Calculator

Find out how much you will need to retire the way that you want to.

“Always buying the cheapest option to save more money”

When I was young, my father would buy me cheap watches from markets nearby. Don’t get me wrong – I used to love them! Press a button and a song will start playing; press another and lights will come flashing. Who cared about the time!

His theory was that because I was just a child, I was bound to damage it and he would need to get me a new one, so he might as well get a cheap watch for me.

True to his theory, those watches never lasted, even though I took care of them. Within weeks, the battery would stop working or the parts would start falling apart.

I can’t remember how many watches he bought to replace the ones that fell apart, but I’m pretty sure that the combined money he spent on all of them was enough to buy a better-quality watch that could have lasted me years.

As I got older, I learned that buying cheap items does not necessarily save you more money in the long run because sometimes, they break down or wear out quicker, and needs replacing more frequently. Now, I invest in better quality items that last a long time. Even if the upfront cost is higher, on a cost-per-use basis, I would be spending just as much or less than the cheaper alternatives.

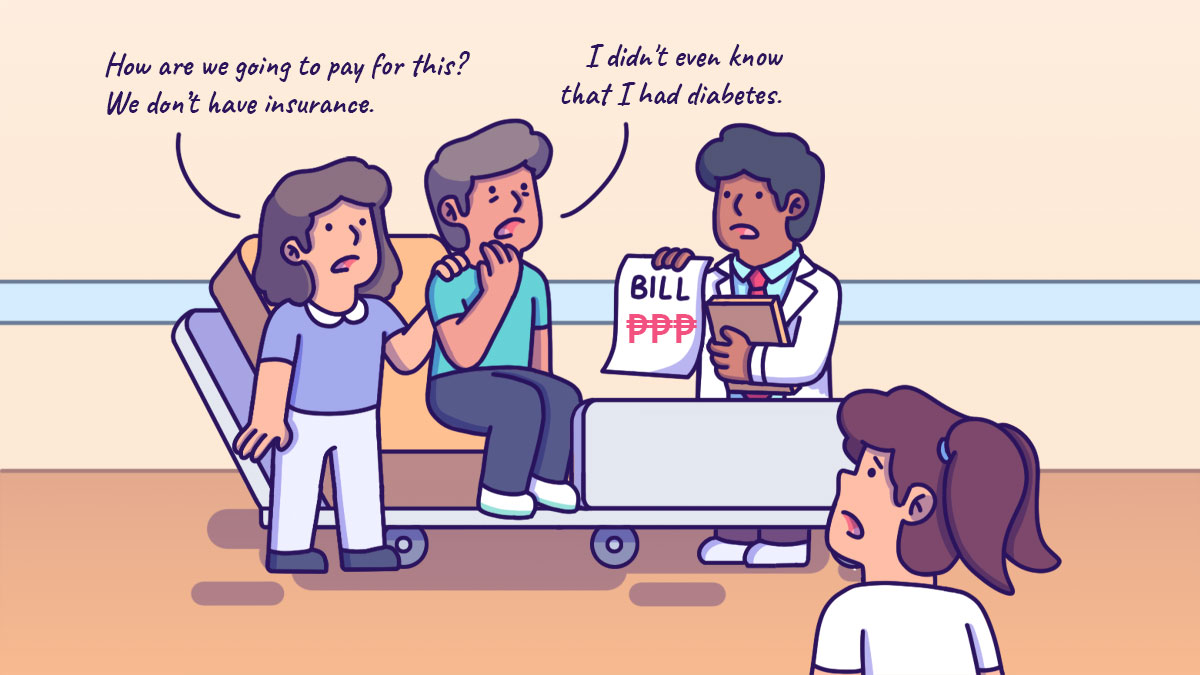

“Don’t waste money on health check-ups or medical insurance”

My parents never saw the importance of going for regular medical check-ups. They also believe that buying health insurance is a waste of money.

I carried this “I’m healthy so why do I have to see a doctor?” mindset well into my adulthood. But I learned later that just because there aren’t any visible health issues, it doesn’t mean that there isn’t a problem. Some medical conditions such as high blood pressure, diabetes, and even the early stages of cancer do not display visible symptoms, and the risk of having these conditions increases as we get older.

Regular medical check-ups could detect these health problems early, and they can be addressed before it becomes worse and cost us more money.

For instance, I never visited a dentist until I felt pain and discomfort in one of my teeth. It turned out that I had a cavity that had gone unnoticed for a long time. By the time I went to the dentist, my tooth had decayed, and it had to be removed. If I had gone for regular dental check-ups, I could have just patched up the cavity before it got to that stage. I would have saved myself a lot of money, a whole lot of pain, and my tooth!

I also learnt that medical bills, especially for serious health conditions, can go up to hundreds of thousands of dollars, and that it’s better to be prepared for the possibility of an unexpected medical diagnosis with health insurance, even if paying the insurance premiums now feels like a waste of money.

Related

“Don’t pay someone for something you can do yourself”

My parents were both working adults but always insisted on doing everything themselves. They drove us to and from school, cooked our meals, cleaned the house, patched up our torn uniforms, and even cut our hair (we’ve all sported our mothers’ rice bowl haircut at one point in our lives).

While doing everything on their own saved them money, it didn’t leave them much time – or energy – to pursue other things such as their hobbies.

Not only that, but sometimes, doing everything ourselves led to disastrous results. Once, in an effort to save money, my mother tasked my father and I to repaint the rooms in our home instead of paying for a professional wall painter. By the end of the session, the paint on the walls were patchy because we weren’t skilled at the task. On top of that, both my father and I had backaches from spending all day painting!

Later in life, I learned that it is okay to pay someone else to do something (and do it better) so that it frees up my time to work on other things.

Tweaking how I think about spending money

While it was difficult at first to break some of these habits as I have been following them since I was young, I managed to do it by taking small steps at a time.

This could mean replacing some of these habits with ones that work better for me like setting a budget for things like massages, travel, or paying for a professional home cleaner so that I don’t feel guilty for paying for convenience or splurging on something I enjoy.

Ultimately, I learned that personal finance is, after all, personal, and we can incorporate or discard habits to help us achieve our own financial goals.