Financial Planning | Personal Finance | Article

Important Expenses You Must Not Forget When Planning For Retirement

by Cherry Wong | April 19, 2024

You may think that retirement planning begins with the goal of saving an amount you deem is sufficient to cover the daily essentials in your golden years.

However, the reality is that retirement finance is more complex than most people think. Many individuals fall into the trap of believing that their basic savings will be enough to sustain them through their golden years. In truth, basic savings only scratch the surface of the untold expenses that retirees may encounter.

Here are various financial considerations often overlooked in retirement planning and emphasises the importance of saving more comprehensively.

Rule #1: Understanding basic savings and its limitations

Basic retirement savings typically cover your daily essential expenses such as food, basic medical needs, and housing.

While this amount is crucial for you to survive, it is not enough to ensure a comfortable and secure retirement.

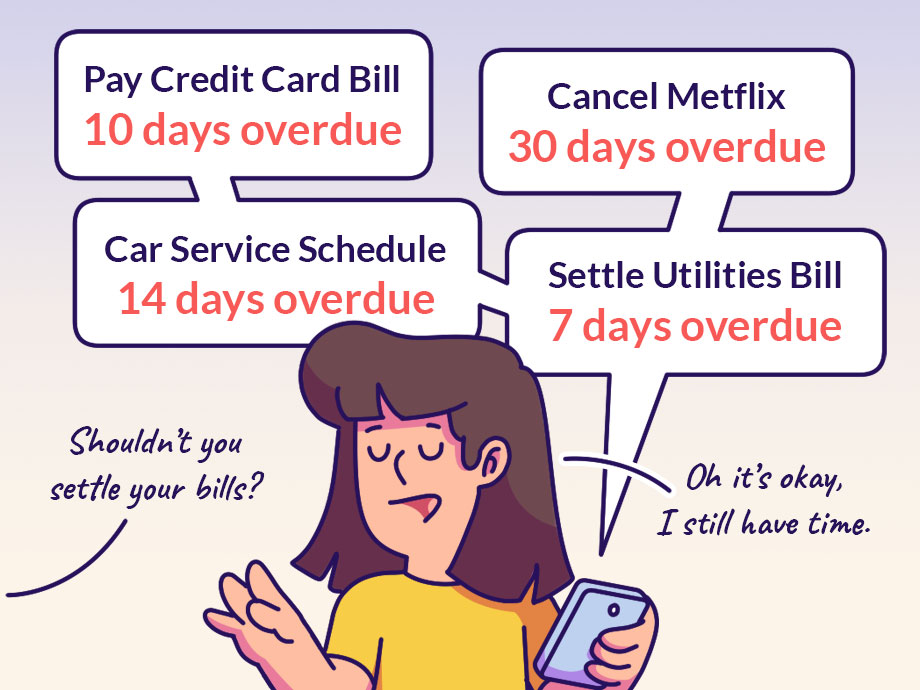

The assumption that these savings are all-inclusive hasn’t considered that ageing comes with added financial commitments and unexpected costs. There are also expenses that you don’t stop paying just because you stop working.

Hence, by understanding the limitations of basic savings you can add on the other likely expenses to your retirement savings.

Related

Rule #2: Knowing what are the expenses you cannot afford to overlook

Things you still need to carry on paying in retirement

Insurance premiums: When you retire, you will still have to continue paying your insurance premium, especially for medical needs. As you age, healthcare needs often increase. Medical insurance needs may evolve and become more expensive in retirement.

Housing and car loans: Retirement does not necessarily equate to the end of your financial commitments. Housing and car loans may continue into retirement, demanding regular payments. Ignoring these obligations can disrupt financial stability and compromise the quality of life during the later years.

Areas of spending that is likely to increase

In retirement, some expenses are likely to increase because of a combination of lifestyle changes, healthcare needs, and personal preferences. Here are some areas where spending is likely to rise in retirement:

Health care costs: As you age, the need for health-related services, beyond what insurance covers, tends to rise.

More frequent routine health screenings, special care and out-of-pocket medications, supplements and specialised treatment costs can contribute to higher healthcare spending in retirement. These other spending have to be added to your retirement planning to make sure that you have the financial means for your health needs in old age.

Dental care: Dental care is often overlooked but can be a significant expense in retirement. Other than the routine scaling and regular check-ups, as you age you may need more specialised treatments such as expensive tooth implants that you need to budget and save for.

Travel and transportation: While commuting expenses may decrease because you don’t need to travel for work, you will still need to commute regularly to buy groceries, attend social gatherings or explore new local places. Hence your transportation expenses can be higher.

Personal care: Expenses related to personal care products, grooming, and other health-related services may increase with age. Having funds for personal care ensures a dignified and comfortable retirement.

Rule #3: Know the big-ticket spending items

In retirement, despite the shift in daily expenses and lifestyle, you may still need to spend on “big-ticket” items. Here are some common big-ticket spending items that retirees may encounter:

Replacements of cars, electronics and tech devices: Cars and tech devices age over time and they need to be replaced when they become obsolete. Because the replacement costs of cars, electronics, and tech devices can be costly, you have to include them in your retirement savings. Planning for these replacements helps avoid getting into debt.

Refurbishment of home: Most renovations have a lifespan of around 10 years, hence you are likely to have to renovate or refurbish your home. Renovations, such as upgrading the kitchen, bathroom, or roof, can be very costly and you will need to have set aside a lump sum for this purpose.

Rule #4: Set up your own discretionary “fun fund”

This is probably the most important and also the most fun part of your retirement savings that you must have.

This fund is for discretionary and enjoyable activities that enhance your quality of life in retirement. While many retirees focus on covering basic living expenses, healthcare, and other necessities, setting aside money for leisure, hobbies, and personal enjoyment is equally important.

Hobbies and personal interests: Retirement is an opportune time to pursue hobbies and interests that may have been neglected during one’s working years. Allocating funds for these activities contributes to a more fulfilling and enjoyable retirement. With more time on their hands, retirees often explore new hobbies and interests. Spending on activities such as golf, gardening, arts and crafts, or educational pursuits may rise.

Travel, dining out, entertainment, and shopping: Beyond meeting basic needs, retirees should budget for activities that bring joy, such as travel, dining out, entertainment, and shopping. These discretionary expenses enhance the overall quality of life in retirement.

Rule #5: Learn about macroeconomic factors such as inflation and interest Rates

Inflation: All expenses are subject to inflation over time. The purchasing power of the current basic savings amount diminishes as prices rise. Even with a modest 2% annual inflation rate, the adequacy of a fixed amount diminishes over the years. Planning for this economic reality is crucial for sustained financial security in retirement.

Interest Rate Movements: Interest rates play a pivotal role in retirement savings. When rates are low, interest-bearing savings and investments yield reduced returns. For those relying on interest as a monthly income, periods of low-interest rates necessitate saving more in principal to maintain financial stability.

Having More Is Better Than Less in Retirement, Anytime!

The key to a secure retirement lies in adopting a proactive and comprehensive approach to savings. Instead of fixating on meeting basic needs, individuals should strive to save more. Starting early and diversifying savings strategies are essential components of a successful retirement plan.

Start saving early and differently: The earlier one starts saving for retirement, the more time their investments have to grow. Compound interest can significantly boost retirement funds, providing a more substantial financial cushion in later years.

Don’t just focus on basic expenses: While covering basic needs is crucial, it is equally important to acknowledge the broader spectrum of potential expenses. Anticipating both expected and unexpected costs ensures that retirees are well-prepared for any financial challenges that may arise.

Strive to save more for anticipated and unanticipated expenses: Aiming for a higher savings goal allows retirees to address unexpected financial hurdles with confidence. Whether it’s a sudden health crisis, necessary home repairs, or a dream vacation, having a financial buffer provides the flexibility to navigate diverse circumstances.

Planning for retirement requires a holistic perspective that goes beyond basic savings.

By acknowledging the various expenses outlined in this guide and understanding the impact of inflation and interest rate movements, individuals can pave the way for a secure and fulfilling retirement. Remember, having more is indeed better than less when it comes to securing your golden years. It’s never too early to start saving for the retirement you envision.