Budgeting | Financial Planning | Personal Finance | Article

Are You Burning Through Your Paycheck Too Quickly?

by Cherry Wong | July 9, 2024

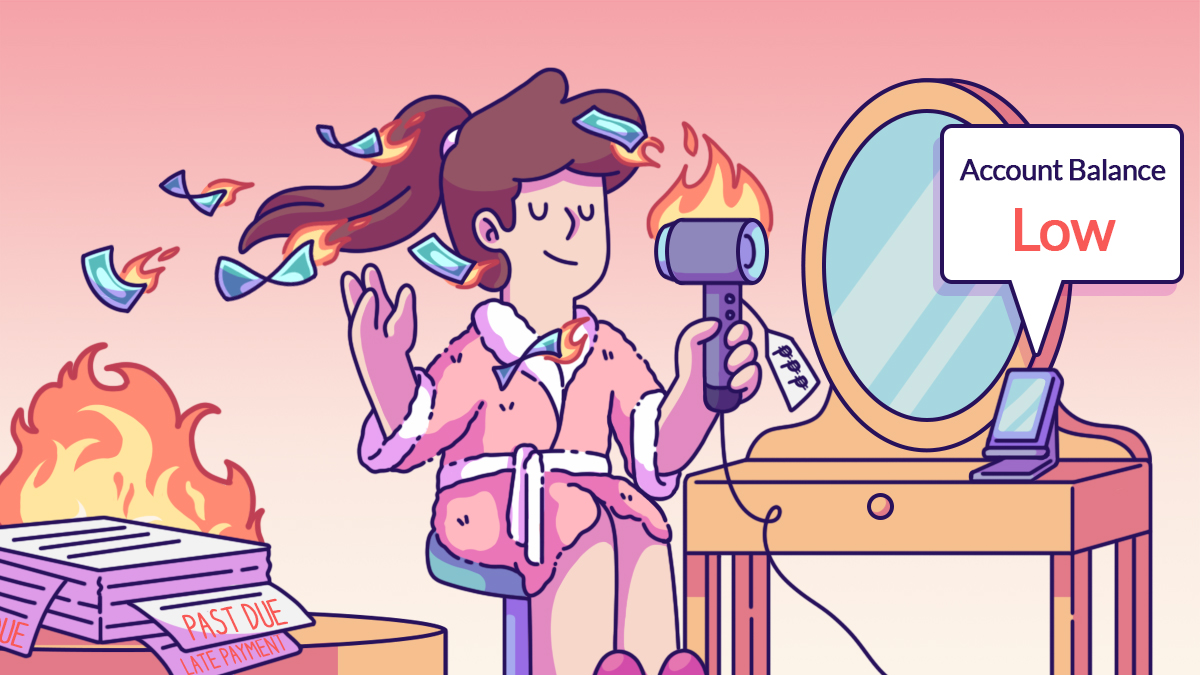

Do you face this situation? Payday arrives, and you’re thrilled to see money fill up your empty account. You can’t wait to buy the groceries, try that new café, and maybe even start investing.

But first, you took care of the essentials: car and house loan repayments, credit card bills, subscriptions, insurance premiums and utilities. Suddenly, most of your money is gone.

You’ve spent 70% of your paycheck in just a few days!

The problem of burning through your paycheck

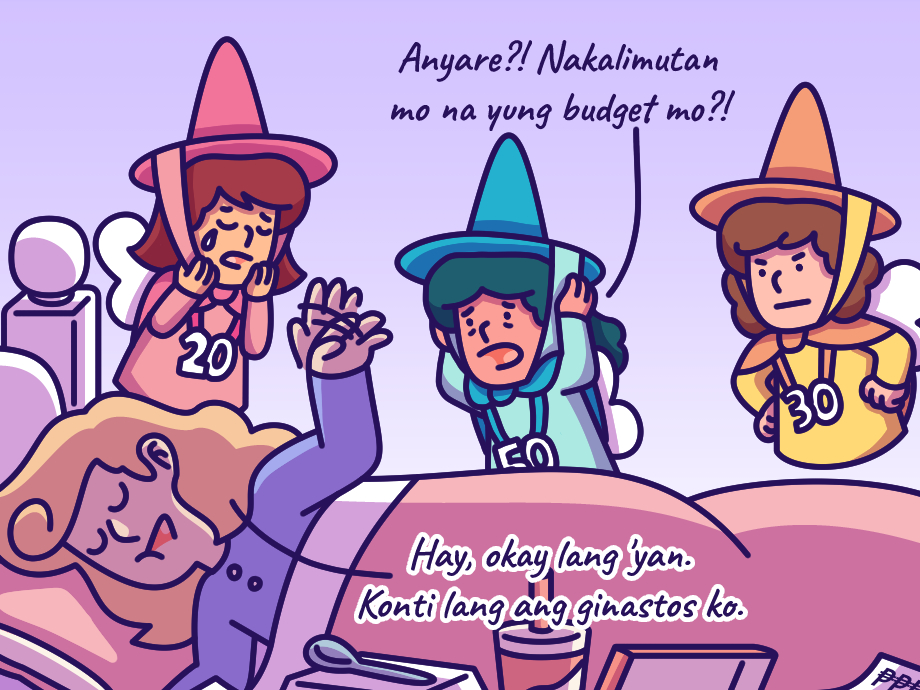

You might think, “I’ll skip the lattes and takeout” to make sure this doesn’t happen again next month. But no matter how hard you try to cut those fun spending, you can’t seem to get out of the situation month after month. Sometimes cutting back on your “wants” is not enough. The real problem is those big, unavoidable expenses that come back every month. They’re like hungry monsters, always taking the first big bite of your paycheck, leaving little for everything else.

If this sounds familiar, you’re dealing with a “high burn rate”. When most of your income goes to fixed costs, you have little left for savings or fun. You might even need to borrow money just to get by. This can lead to a cycle of debt and worry. It’s a common money management problem, but understanding it is the first step to fixing it.

What does burn rate mean

Think of your money as fuel for a car. The burn rate is how fast you use up that fuel. In the business, it’s about how quickly a company spends its cash. For regular people, it’s how fast we go through our paychecks.

When you get paid, that’s like filling up your money tank. A high burn rate means you’re speeding down the highway, burning through that cash at top speed. Before you know it, your tank is almost empty, and you’re not even halfway through the month!

For businesses, a high burn rate can be risky. It’s like a car using too much gas on a long trip – they might run out of money before making a profit. Companies that burn cash too quickly often don’t last long.

For us, a high personal burn rate means we’re spending a big chunk of our income really fast. It’s like stepping on the gas pedal as soon as we leave the bank. This can leave us struggling to make ends meet until our next paycheck.

Related

If you have a high burn rate, you are likely…

Having a hard time saving money. When most of your income goes out quickly, there’s little left to set aside. This means you probably don’t have much in savings.

Struggling with debts. When you’re spending so much of your income, you might need to use credit cards or loans to cover your basic needs, creating a hard-to-break borrowing cycle.

Living paycheck-to-paycheck: You’re using up almost all your money before your next payday, leaving no financial cushion.

Difficulty building wealth for the future: Without savings or investments, you’re not giving your money a chance to grow over time.

Even if you earn a good salary, a high burn rate can still leave you struggling. High income doesn’t automatically mean financial security if your expenses are eating up most of what you make. The key is to have money left over after covering your needs and some wants.

What’s causing your high burn rate?

Many people think cutting back on small things like coffee or shopping will solve their money problems. While that helps, it’s often not the whole story.

The big money-eaters are “fixed expenses” – bills that show up every month and must be paid. Think about rent or mortgage, car payments, insurance, and subscriptions. These costs take a big bite out of your paycheck before you even think about other expenses.

Fixed expenses don’t change much from month to month. Your landlord doesn’t lower the rent just because you’re trying to save more. That’s why just cutting back on small luxuries often isn’t enough. To really change your financial picture, you need to look at these big, regular expenses. Can you find a cheaper place to live? Do you really need all those subscriptions? These are the questions that can lead to real savings.

Related

How to slow your burn rate

It starts with taking a good look at those big bills that show up every month.

Housing is probably your biggest expense. Could you move to a less expensive place? If you own the property, consider refinancing it for a lower monthly payment. Every dollar saved here can make a big difference.

Next, consider your car. Do you really need the newest imported model with all the fancy features? A reliable used car can work just as well and costs much less each month. A car’s job is to get you where you need to go safely.

What about all those subscriptions? Go through them one by one. Do you really use that streaming service or that gym membership? If not, it might be time to cancel. For things that you can pay for on-demand, you could try paying for each use instead of a monthly fee. This way, you only pay for what you use.

If you have debts, look into ways to lower your payments. Sometimes you can combine different debts or find better interest rates. This could help you pay less each month and get out of debt faster.

Now, let’s look at your energy bills. They can add up fast without you noticing. Try using energy-saving light bulbs and turning off lights when you leave a room. These small changes can lead to big savings on your electricity bill over time.

By focusing on these big, regular expenses, you can make real changes to your spending. It might take some effort, but the results can be worth it. You’ll have more money left over each month, which means less stress and more freedom to save or spend on things you really care about.

Managing your paycheck wisely

Many people think cutting small luxuries is the answer to saving money. While that helps, it’s often not enough.

The real key is looking at those big, regular expenses that eat up most of your paycheck. Your goal is to find a happy middle ground – our ideal burn rate. It’s not about pinching every penny.

Instead, focus on making smart choices with your bigger expenses. This way, you can live well, pay your bills without stress, and still save for the future.